Climate Change Conference COP 26 in Glasgow

Centre for Climate and Energy Analysis (CAKE) was present at the EU side events during the COP26 – UN Climate Change Conference, which was held in Glasgow on November 1-12, 2021. This year CAKE had an opportunity to participate in two side events which took place in the EU Pavillon on the 4th of November. We invite you to read the short extract from both of these events.

- Side event nr 1: “Pricing Carbon to Support a Transition to Net Zero” (link do video)

This event was organized in two session. The first session was focused on the roadmap to achieve net-zero at the national and subnational level. This session was chaired by Artur Runge Metzger (former Director of Climate in DG Climate Action). Distinguished panelist include: Gregory Barker (, En+ Group), Catarina Selada (CEiiA/Centre of Engineering and Product Development), Yan Qin (Refinitiv), Vicky Pollard (DG Climate Action).

Robert Jeszke (CAKE) presented the main outocomes of CAKE analysis „Poland net-zero 2050“. The decarbonisation target which is a part of “Fit fo 55” package is very ambitious and can only be achievable with swift technological progress (i.e. transport, agriculture and industry) and adequate access to financial resources which is crucial both for public and private sources. In case of Poland most of emission reduction would take place in the energy sector (reduction of the fossil fuel’ use and increse share of RES), but the role of this sector in the overall decarbonisation effort will decrease over time. This sector will be responsible for 80% of total emission reduction by 2030 (relative to 2015) and 55% of the reduction by 2050. This implies that a large share of reduction potential in the energy sector will be utilised in the first transformation period (2030), while the following transition will increasingly rely on costly GHG mitigation options in industry, transport and agriculture in the following period (2050).  The reduction of fossil fuels’ use and deployment of RES are not sufficient to achieve climate neutrality by 2050 in EU and Poland. There is also a need for a large scale adoption of BECCS, CCS, and CCU technologies, electrification of industry, adoption of hydrogen technologies, spread of electromobility and new solutions in agriculture. Development of carbon pricing both carbon taxes and emission trading systems around the world is growing in response to urgent calls for climate action. But even enormous growth, carbon-pricing initiatives still only cover a small share of global emissions and fall short of international mitigation goals. It is going to change in the nearest future, if the world seriously want to be on a global scale on the net-zero pathway. However, it won’t be an easy task.

The reduction of fossil fuels’ use and deployment of RES are not sufficient to achieve climate neutrality by 2050 in EU and Poland. There is also a need for a large scale adoption of BECCS, CCS, and CCU technologies, electrification of industry, adoption of hydrogen technologies, spread of electromobility and new solutions in agriculture. Development of carbon pricing both carbon taxes and emission trading systems around the world is growing in response to urgent calls for climate action. But even enormous growth, carbon-pricing initiatives still only cover a small share of global emissions and fall short of international mitigation goals. It is going to change in the nearest future, if the world seriously want to be on a global scale on the net-zero pathway. However, it won’t be an easy task.

If we take an example of the EU ETS it is the most advanced system worldwide, covering around 50% of EU CO2 emissions and it is going to change significantly in the nearest future, in line with the EU plans to reach carbon neutrality by 2050 by the expansion of EUETS to new sectors (transport and buildings) or the introduction of the border tax (CBAM). Thus, the carbon pricing will gain importance, not only in the EU, but also in other countries. Due to the unitary nature of the ETS, there is a serious risk of unequal and unfair distribution of the costs of abatement and concerns about social costs. The introduction of CBAM on the EU could have an impact on the pace of the introduction of the solutions based on the “carobon pricing in different regions in the world. Above all, it aims to protect european businesses and industry from the risk of carbon leakage and relocation of production outside the EU, which is a side effect of emission reductions. The CBAM proposed by the EU even before its implementation is playing a role of a motivator for proclimate activities and the development of ETS in different regions. This is also a first step to think on global scale on linking different schemes which are developed around the world. Therefore, CAKE is working now on a new project LIFE VIIEW 2050 which main goal is to assess the functioning of the EU ETS, its impact and iteraction with other ETS which are deployed globally and it’s possible further development for a climate neutral economy by 2050.

Vicky Pollard (European Commission) described the functioning of the EU ETS over the years. Since 2005, many changes have been made to this system, increasing the reduction targets and the linear reduction factor (LRF). As a result, over the last 16 years it has been possible to reduce emissions by approx. 42.7%, which is the best tool to measure the effectiveness of this system. A new reduction target (55%) to 2030 as part of the Fit for 55 package has recently been approved. This reform of the EU ETS system aims to generate a price signal that will allow participants to reduce emissions and achieve zero emissions in 2050.  The 55% reduction target in the EU translates into the 61% reduction target in the EU ETS, which means the need to raise the LRF to 4.2%. In addition, there is a tightening of the MSR reserve mechanism in order to “avoid price shocks”. In addition, the focus has been more on free allocation of allowances, which is to be restricted in many sectors (e.g. aviation). Greater reduction ambitions are associated with a greater risk of carbon leakage. That is why the European Commission has proposed the CBAM border tax, which is provided for several sectors, and at the beginning there will be a transitional phase based on reporting emissions in products (importers will be temporarily exempt from fees). The EU ETS system will be extended and would include maritime transport, and also a separate ETS system will be created for buildings and transport. It is very difficult to reduce emissions in these sectors and there is a need to provide the market with appropriate technologies and solutions. It is also important to properly manage the revenues from auctions, which should be allocated entirely to environmental purposes. In the reformed EU ETS there are separate funds (Modernisation fund and Innovation Fund), Just Transition Fund and the Climate Social Fund from the new ETS which should to take into account social needs.

The 55% reduction target in the EU translates into the 61% reduction target in the EU ETS, which means the need to raise the LRF to 4.2%. In addition, there is a tightening of the MSR reserve mechanism in order to “avoid price shocks”. In addition, the focus has been more on free allocation of allowances, which is to be restricted in many sectors (e.g. aviation). Greater reduction ambitions are associated with a greater risk of carbon leakage. That is why the European Commission has proposed the CBAM border tax, which is provided for several sectors, and at the beginning there will be a transitional phase based on reporting emissions in products (importers will be temporarily exempt from fees). The EU ETS system will be extended and would include maritime transport, and also a separate ETS system will be created for buildings and transport. It is very difficult to reduce emissions in these sectors and there is a need to provide the market with appropriate technologies and solutions. It is also important to properly manage the revenues from auctions, which should be allocated entirely to environmental purposes. In the reformed EU ETS there are separate funds (Modernisation fund and Innovation Fund), Just Transition Fund and the Climate Social Fund from the new ETS which should to take into account social needs.

Yan Qin (Refinitiv) referred to the cap and trade system launched in China this year, which accounts for as much as 40% of China emissions. It is true that the price for emission allowances in this system is not high so far (around EUR 6-7 per allowance), but at the time of reforming the system it should be higher. More sectors are expected to be included in the system by 2025. It is expected that by 2030 the price for Chinese emission allowances should rise to EUR 20 by 2030, and even to EUR 40 in the same year, if the supply of allowances is reduced (the cap). Carbon tax may be a good idea to reduce emissions in other countries as an alternative to ETS systems.

Catarina Seleda (Centre for Engineering and Development, CEIIA) presented the AYR Platform project, which aims to calculate avoided emissions in cities and create local emissions trading markets. Currently, the AYR platform operates in Matoshinos, Portugal, Brazil, and will be developed in Europe. The AYR platform determines the emissions avoided by city dwellers when they do not use car transport and consequently they do not produce CO2 (e.g. through the use of clean means of transport). As a result, the avoided emissions are converted into tokens and their users can exchange them for certain services or goods. This platform is intended to support the emergence of local voluntary carbon markets.

*****************************************************************************************************************

Louis Redshaw (Redshaw Advisors Ltd) was a moderator during the second session which was focused on rising to the challenge of Net- Zero: global carbon pricing and Article 6 of Paris Agreement. Panelists in this session include: Andrei Marcu (European Roundtable on Climate Change and Sustainable Transition, ERCST), Sha Yu (University of Maryland) and Elisabeth Sturcken (EDF).

Louis Redshow (Redshaw Advisors) admitted that achieving climate neutrality around the world will be a real challenge and it will be possible through the use of mechanisms based on “carbon pricing”, eg. in accordance with Art. 6 of the Paris Agreement. Voluntary Carbom Markets (VCM) can be an interesting perspective as a tool to reduce emissions in the world. Until now, this market has not had a secondary market and this has changed now. However, the VCM market, unlike the CO2 market, has no legal rules. Earlier, the CDM (Clean Development Mechanism) was available in the EU and it should be considered whether the VCM market would go in the same direction. The offset market is projected to increase its share to around 10% by 2050. It should be noted that the most expensive market in the world today is the EUA market in Europe, where allowances are valued at around $ 70 (EUR 60). Meanwhile, offset units (Carbon removals) cost only about $ 5-10. The future of the VCM market depends on the introduction of specific rules and legislation (as this is not a compliance market). There is a good chance that international CO2 markets will help to achieve global climate neutrality in the world.

Andrei Marcu (ERCST) acknowledged that the VCM market can play an important role in certain sectors in helping to achieve emission reductions. He stated that it would not be possible to achieve climate neutrality without the use of CCS technology, which would be profitable when the price for EUA allowances would be above EUR 100. New technologies that need to be introduced to the market are very important in this context. The role of CO2 markets is a price signal that provides incentives to reduce emissions. Does the VCM market meet these conditions? Not really, because there are no regulations on this market which would have a role to force higher prices. The VCM market can reach small up to EUR 20, which will not force an issue. Therefore, regulated markets (such as the EU ETS) are more efficient.

Sha Yu (University of Maryland) presented the role of Art. 6 in the context of achieving climate neutrality. Article 6 could drastically reduce reduction costs by as much as $ 21 trillion between 2020 and 2050. Meanwhile, relying on the NDC’s alone it will cut reduction costs by only $ 13 trillion. The trend on the market will be such that the number of transactions on CO2 markets will decrease in the world, while their value will increase. Land sinks and Carbon removals will be very important in the future. Equity investment will flow from developed countries to developing countries.

Elisabeth Sturcken (European Defence Fund) added that VCM could be a good platform to emission reduction which would motivate companies to reduce emisssions. The actions is needed now, emissions needs to be reduced faster by high quality Carbon ofssets, which are great tool for companies to reduce emissions.

- Side event nr 2: “Carbon markets & net-zero: trends and prospects in the domestic, international and voluntary markets” (link do video)

CAKE (KOBiZE) coorganized the event in which apnellist include Dirk Weinreich (Germany’s Minister of Encvironment), Stefano De Clara (Head of the Secretariat of the International Carbon Action Partnership, ICAP), Simone Borghesi (Director of Florence School of Regulation Cl and Brad Schallert – Director, Carbon Market Governance and Aviation, World Wildlife Fund (WWF-US).

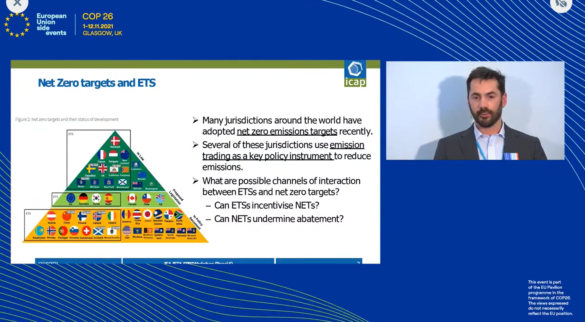

Carbon markets are expected to make a significant contribution to achieving net zero emissions (NZE) by the middle of the century. Realizing their potential requires a strong national and international compliance and voluntary policy framework. This event discussed how existing carbon markets can help achieve NZE, including through high-quality carbon credits, integration of carbon removals and integration of major carbon markets.

Dirk Weinreich Germany’s Minister of the Environment spoke about the need to extend the current ETS systems to buldings and road transport. The system covering these sectors is already in place in Germany. Stefano De Clara (ICAP) presented and discussed the document: Emissions Trading Systems and Net Zero: Trading Removal, prepared by ICAP. According to the presentation, this report will help to understand the challenges of how net zero emissions targets can pose for the operation of emission trading systems (ETS) and develops a number of models for possible interactions between ETS systems and negative emission removal units (NETs).

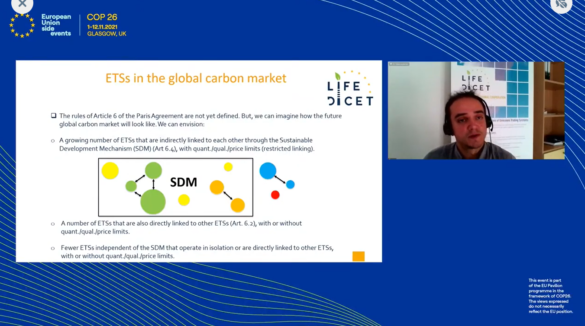

Simone Borghesi (FSR, EUI) and Stefano F. Verde (EUI) gave a presentation on their work in the LIFE DICET. Simone Borghesi spoke about possible reforms in the carbon markets in order to integrate them. He presented the FSR ongoing project called: The Life DICET , which main goal is to support EU politicians and member states in deepening international cooperation for the development and integration of emission markets around the world. The project will cover the EU, China, New Zealand, California, Quebec and Switzerland. Stefano VERDE (EUI) talked about ETS systems in the global market, connecting systems and ways to facilitate these connections, and about the acceptable level of allowance prices.

Brad Schallert (WWF-US) gave a presentation the Carbon Credit Quality Initiative project, which was created in cooperation with OKO Institute, WWF and EDF (Environmental Defense Fund) and whose main goal is to create an independent system for the assessment of carbon credits. The project will also prepare a guidance for potential carbon credit buyers.

Back

Reset ustawień

Reset ustawień Kontrast

Kontrast Widok

Widok Czytelność

Czytelność Czcionka

Czcionka Znaki

Znaki Interlinia

Interlinia Słowa

Słowa Akapity

Akapity Deklaracja dostępności

Deklaracja dostępności