Key takeaways from Ariadne Project workshop on MSR & CO2 prices

Together with analysts from ICIS, Refinitiv, Veyt, BNEF and scientists from PIK, Enerdata, CAKE/KOBIZE took part in very interesting and important workshop organized by the Ariadne Project in Brussels on December 6, 2023, focusing on the evolution of EU ETS prices and the functioning of the Market Stability Reserve (MSR).

Following up on the workshop conducted last year on the evolution of EU-ETS prices through 2030 and beyond, this year’s event was want to take a closer look at the functioning of the MSR – also with a view on its upcoming review in 2026. The focus of the model based discussion was the years until 2030, but effects post 2030 had also been considered bacause of the potential impact MSR behaviour in this decade.

The goal of the workshop was twofold. First, to discuss important updates of the models, implementation details as well as core assumptions that happened since the last workshop. Second, to look into and discuss results of the different models for the evolution of the TNAC and the operation of the MSR.

Specific questions we are interested in include:

- Will the TNAC continue to decline, and in the mid to long term coevolve with the cap? Or will it go up again, because market participants engage in pronounced banking in anticipation of ever high scarcity?

- Related, when will the MSR “temporarily stop operation” because the TNAC has fallen below the intake threshold? When is the MSR bound to start reinjecting allowances in the market? How many allowances will be cancelled overall through 2030?

- How likely are large demand shocks in the coming years? What would happen in case a large (positive) demand occurs when the MSR is temporarily inactive? Would the MSR be capable of stabilizing the market?

- The structural changes in the market suggest that the MSR rules need to be adjusted in the next review. How could the rules for e.g. the intake/outtake threshold be adjusted? Is reforming the MSR into a more price-based mechanism a viable option?

The workshop is jointly organized by PIK, ICIS and Ecologic, and supported by the German Ministry of Science as part of the project Ariadne.

During the meeting, CAKE experts emphasized the issue of a shortage of allowances, which will become a key challenge in the second half of the coming decade. At that time, the EU ETS might lose one of its most crucial functions, namely, ensuring allowances in the primary market. The current form of the MSR and its existing limitations regarding increasing the market supply of allowances could contribute to market destabilization by allowing for extremely high allowance prices. One potential solution to these issues could be the establishment of the European Central Carbon Bank (ECCB), tasked with managing allowance liquidity and supporting the stability of the EU ETS as a pivotal element of the EU’s climate policy.

During the meeting, CAKE experts emphasized the issue of a shortage of allowances, which will become a key challenge in the second half of the coming decade. At that time, the EU ETS might lose one of its most crucial functions, namely, ensuring allowances in the primary market. The current form of the MSR and its existing limitations regarding increasing the market supply of allowances could contribute to market destabilization by allowing for extremely high allowance prices. One potential solution to these issues could be the establishment of the European Central Carbon Bank (ECCB), tasked with managing allowance liquidity and supporting the stability of the EU ETS as a pivotal element of the EU’s climate policy.

Here you can find the summary takeaways and input materials from the workshop “MSR through 2030: impact on market liquidity and considerations for the 2026 reform”:

- https://ariadneprojekt.de/media/2023/12/Ariadne-Documentation_ETSWorkshopBruessel_December2023.pdf

10 Key takeaways include:

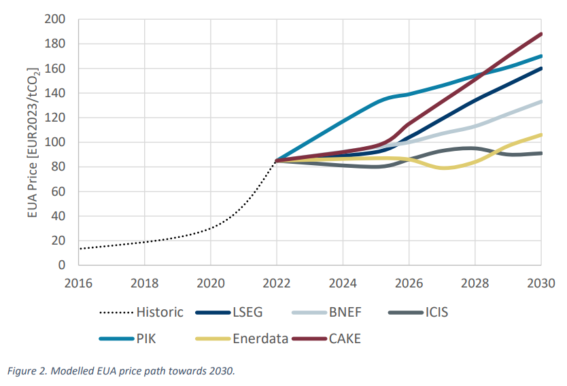

- EUA Price Projections Until 2030: There’s a general consensus on a significant rise in EUA prices, especially in the second half of the decade. Projections vary, with prices expected to remain below 100 EUR2023/tCO2 by 2025, but rising to between 91 and 188 EUR2023/tCO2 by 2030. This indicates an increasingly tight carbon market.

- Factors Influencing Price Projections: The increase in prices is driven by scarcity, but tempered by the expansion of RES and uncertainties in industrial development. Some models, project lower prices due to a structural trend towards decarbonization and allowance supply exceeding the cap. Contrarily, CAKE/KOBiZE projects one of the highest prices due to increased auction volumes and subsequent shortages after 2026.

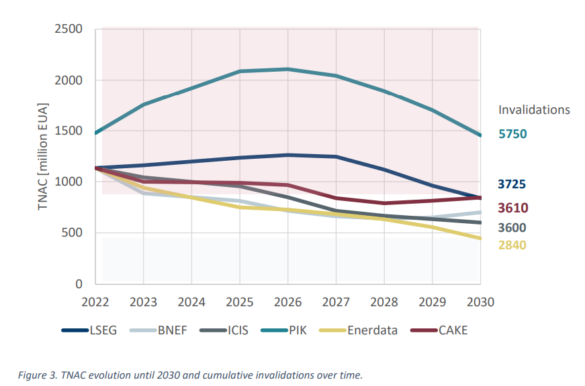

Market Stability Reserve (MSR) Dynamics: By 2030, most models predict that the MSR will become inactive, neither absorbing nor releasing allowances. This reflects a significant shift in the carbon market’s dynamics and is crucial for long-term carbon pricing strategies.

Market Stability Reserve (MSR) Dynamics: By 2030, most models predict that the MSR will become inactive, neither absorbing nor releasing allowances. This reflects a significant shift in the carbon market’s dynamics and is crucial for long-term carbon pricing strategies.

- Influence of Foresight on MSR Dynamics: The models demonstrate varying assumptions about market foresight, which significantly influences MSR behavior. For instance, the PIK model assumes perfect foresight, leading to longer MSR activity and more invalidations, while others like ICIS and LSEG assume limited foresight, resulting in lower TNAC than PIK but higher than other model.

- Economic Outlook and Market Behavior: The current economic state influences market behavior, with businesses more focused on short-term survival, affecting their approach to allowance trading. This situation underscores the importance of political stability and market confidence for long-term planning.

- Industrial vs. Power Sector Abatement: The projections suggest that uncertainty in the industrial sector’s abatement capacity is more significant than in the power sector. Primarily due to heterogeneous abatement options and dependencies on public subsidies for transformation projects. This uncertainty in industrial emissions abatement becomes critical for future carbon market dynamics and pricing.

Potential MSR Improvements: Discussions about improving the MSR’s functionality include adjusting key parameters like intake and release thresholds and applying linear reduction factors to MSR thresholds. As the EU ETS moves towards net zero, this adaptation is seen as necessary for maintaining the effectiveness of the MSR.

Potential MSR Improvements: Discussions about improving the MSR’s functionality include adjusting key parameters like intake and release thresholds and applying linear reduction factors to MSR thresholds. As the EU ETS moves towards net zero, this adaptation is seen as necessary for maintaining the effectiveness of the MSR.

- Alternatives for Market Stabilization Mechanisms: The suitability of the MSR in its current form for stabilizing the market as the EU approaches net zero is questioned, leading to discussions on alternative mechanisms, including price triggers and the possibility of establishing a Carbon Central Bank, despite potential legal and political challenges.

- Challenges Beyond 2030: As the EU moves towards net zero, the MSR’s transition from inactive mode raises concerns about market stability and the flexibility of the cap. Solutions like linking release volumes to remaining allowances in the MSR and using international or removal credits are considered.

- Long-Term ETS Effectiveness: As the EU approaches net zero, there are questions about the continued suitability of the ETS for reducing emissions. Strategies for ensuring a “soft landing” and integrating Carbon Direct Removals (CDR) into the system are considered crucial for the final approach to net zero.

These results indicate a complex and evolving carbon market, with significant implications for future EU carbon pricing and climate policy strategies.

Back

Reset ustawień

Reset ustawień Kontrast

Kontrast Widok

Widok Czytelność

Czytelność Czcionka

Czcionka Znaki

Znaki Interlinia

Interlinia Słowa

Słowa Akapity

Akapity Deklaracja dostępności

Deklaracja dostępności